mississippi state income tax brackets

As of January 1 2022 Mississippi has completed the phaseout of its 3 percent individual income tax brackets. The legislation contains language that the plan will be examined by 2026 with an eye toward personal income tax elimination.

Mississippi Tax Rate H R Block

Many states do not release their current-tax-year 2021 brackets until the beginning of the following year and the IRS releases federal tax brackets for the current year between May and December.

. Detailed Information about Mississippi state income tax brackets and rates standard deduction information and tax forms by tax year etc. Mississippi has some of the most generous exemptions for retirement income of any US. Details on how to only prepare and.

The corporate rates and brackets match the individual rates and brackets and the. If you are receiving a refund. We do our best to ensure that all of our tax rates are kept up to date - but if you.

Mississippis maximum marginal corporate income tax rate is the 3rd lowest in the United States ranking directly below North Dakotas 5200. Detailed Mississippi state income tax rates and brackets are available on this page. Another 10 have a flat tax rateeveryone pays the same percentage regardless of how much they earn.

Over 85 million taxes filed with TaxAct. All of our bracket data and tax rates are updated yearly from the IRS and state revenue departments. Residents of Mississippi are also subject to federal income tax rates and must generally file a federal income tax return by April 18 2022.

South Dakota and Wyoming are the only states that levy neither corporate income nor gross receipts taxes. Mississippi Income Tax Rate 2020 - 2021. SB 3164 originally cut sales tax on groceries from 7 to 5 phased out the 4 income tax bracket over four years cut the states portion of the car tag revenue and provided a one-time rebate check of up to 1000 for citizens with tax liability.

The House passed the measure 92-23. These income tax brackets and rates apply to Mississippi taxable income earned January 1 2020 through December 31 2020. Mississippi collects a state corporate income tax at a maximum marginal tax rate of 5000 spread across three tax brackets.

The Senate voted 39-10 to pass the measure on Sunday with five Democrats joining the Republican majority in favor. Mississippi State Income Tax Forms for Tax Year 2021 Jan. Mississippis income tax currently has three marginal rates of 3 percent 4 percent and 5 percent.

Mississippi Senate income tax cut plan makes its way through Finance Committee. The tax brackets are the same for all filing statuses. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower.

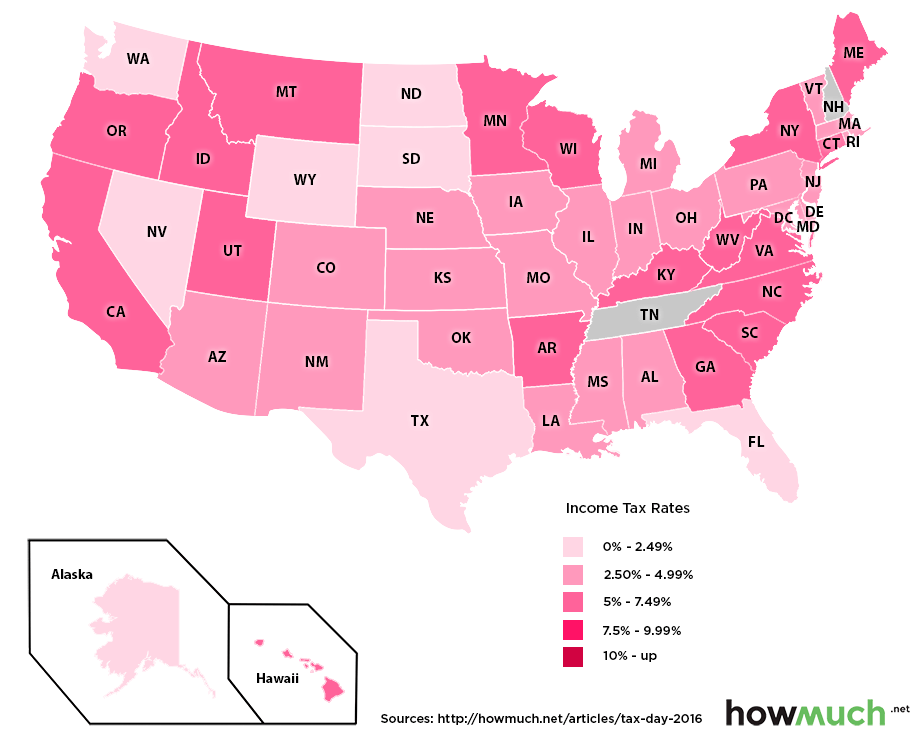

TAX DAY NOW MAY 17th - There are -379 days left until taxes are due. Income sources that are exempt from state taxes include Social Security retirement benefits pensions 401ks and IRAs. Overall state tax rates range from 0 to more than 13 as of 2021.

Explore state individual income tax rates and brackets for 2021. Start filing for free online now. 2022 Mississippi Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

Corporate income tax is levied in 44 states. Tate Reeves on Tuesday signed a bill that. 2021 Mississippi Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

The only marginal individual income tax rate Wisconsin has left unchanged since 2019 is the one that has the most detrimental impact on labor and investment in the state. Corporate income tax rates 2015 State Tax rate Brackets Number of brackets Lowest Highest Mississippi. Ad Import tax data online in no time with our easy to use simple tax software.

Prior to 2022 the Pelican States top rate ranked 25th. California Hawaii New York New Jersey and Oregon have some of the highest state income tax rates in the country and eight states have no tax on earned income at all. All other income tax returns.

Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. Mississippi Governor Tate Reeves R in his budget proposal for fiscal year FY 2022 has announced his goal of phasing out the states income tax by 2030. Because the income threshold for the top bracket is quite low 10000 most taxpayers will pay the top rate for the majority of their income.

The state has been slowly eliminating its lowest tax bracket by exempting 1000 increments. The table below lists the corporate income tax rates for Mississippi and neighboring states in 2015. Can be found on this page.

Mississippi Income Taxes. Mississippis sales tax rates are close to. At 765 percent Wisconsins rate is the 10th highest in the nation lower than that of only eight states and the District of Columbia.

AP Mississippi residents will pay lower income taxes in coming years as the state enacts its largest-ever tax cut. Mississippi state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with MS tax rates of 0 3 4 and 5 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. Although often regarded as a major tax type corporate income taxes account for only 493 per cent of state tax collections on an average and 226 per cent of the states general revenue in FY20.

Additionally the state has property taxes that rank among the lowest in the country. The Mississippi Single filing status tax brackets are shown in the table below. Mississippi residents have to pay a sales tax on goods and services.

Taxpayer Access Point TAP Online access to your tax account is available through TAP. Mississippis sales tax rate. Reduce state income tax revenue by 525 million a year starting in 2026.

The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5. Mississippi has three marginal tax brackets ranging from 3 the lowest Mississippi tax bracket to 5 the highest Mississippi tax bracket. Mississippis income tax brackets were last changed four years prior to 2020 for tax year 2016 and the tax rates have not been changed since at least 2001.

31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. After the first year the tax-free income levels would be 18300 for a single person and 36600 for a married couple lawmakers said. Start filing your tax return now.

The top marginal rate. Mississippi sales tax rates. Harkins said the tax cut would reduce state revenue by 185.

The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022. The Mississippi tax rate and tax brackets are unchanged from last year.

Which U S States Have The Lowest Income Taxes

Mississippi Income Tax Calculator Smartasset

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation

Tax Rates Exemptions Deductions Dor

State Corporate Income Tax Rates And Brackets Tax Foundation

How To Calculate Income Tax In Excel

How Do State And Local Individual Income Taxes Work Tax Policy Center

Where S My Mississippi State Tax Refund Taxact Blog

How High Are Capital Gains Taxes In Your State Tax Foundation

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

State Income Tax Rates Highest Lowest 2021 Changes

Excel Formula Income Tax Bracket Calculation Exceljet

Mississippi Income Tax Calculator Smartasset

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

Tax Friendly States For Retirees Best Places To Pay The Least

Mississippi Tax Rate H R Block

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map